Views: 4 Author: Hicend Futures Publish Time: 2025-10-30 Origin: Hicend Futures

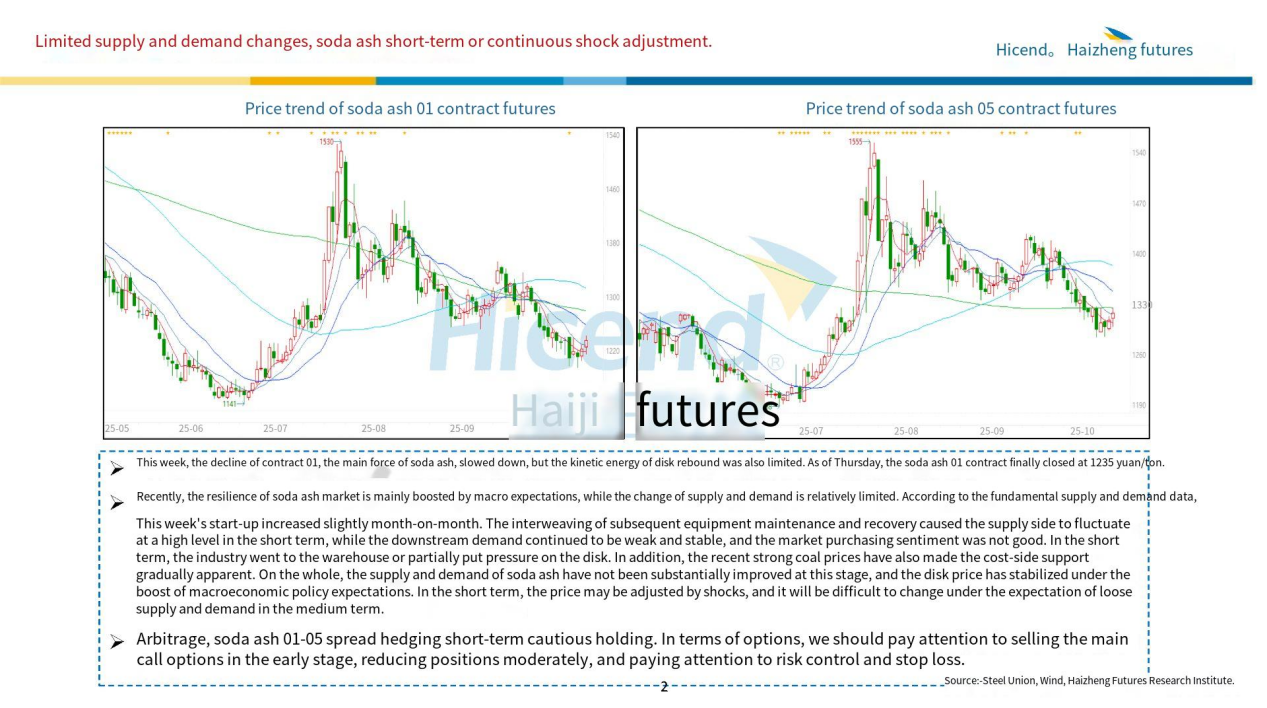

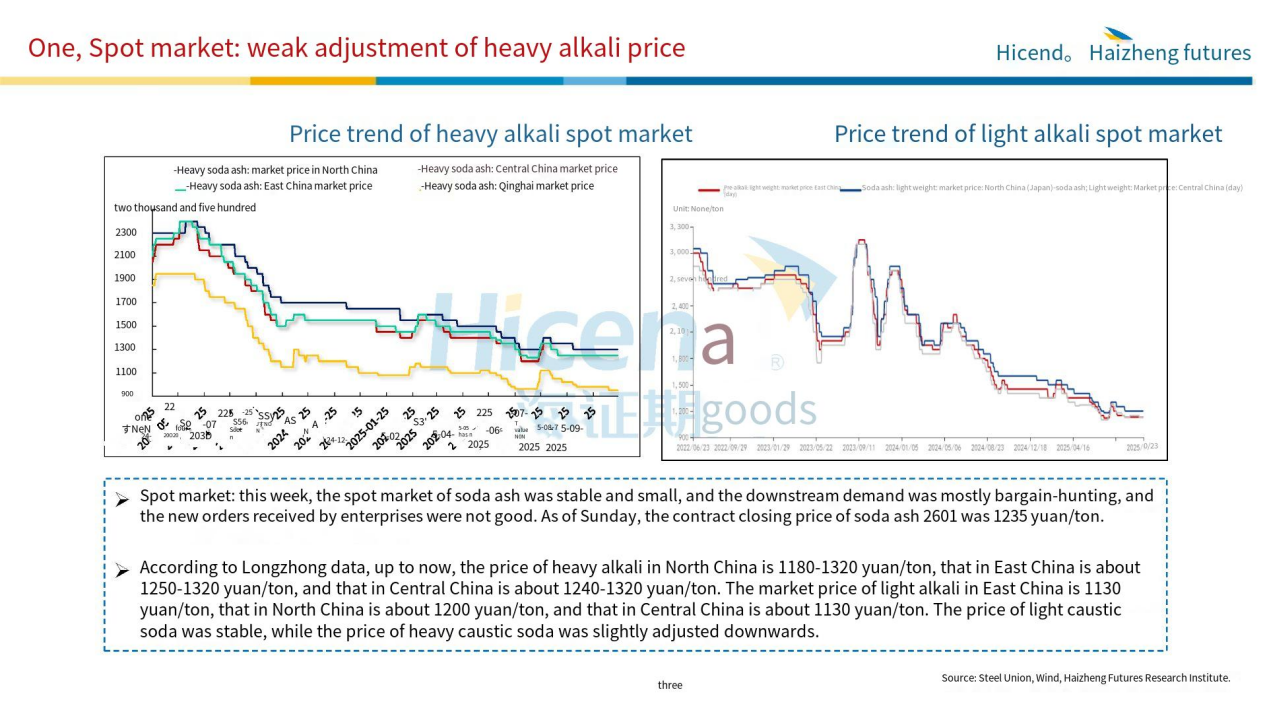

This week, the downward momentum of the main soda ash 01 contract moderated, though its rebound potential remained limited. By Thursday's close, the 01 contract settled at ¥1,235 per tonne.

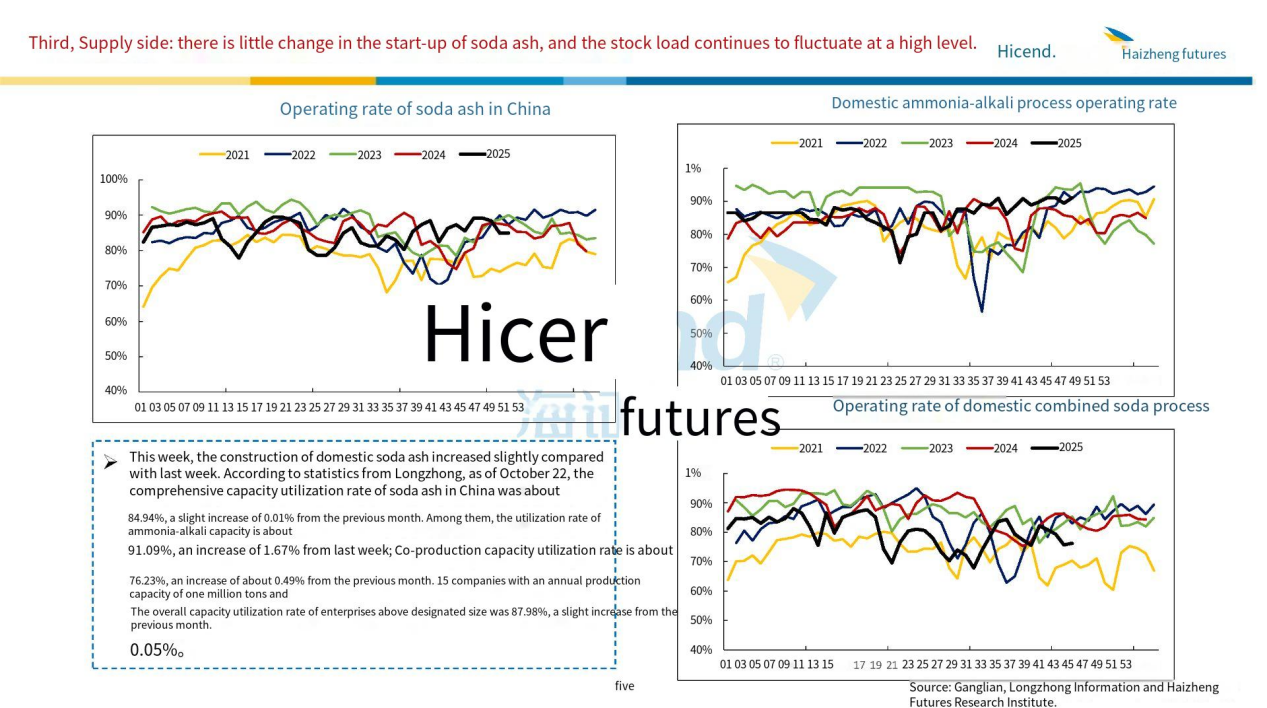

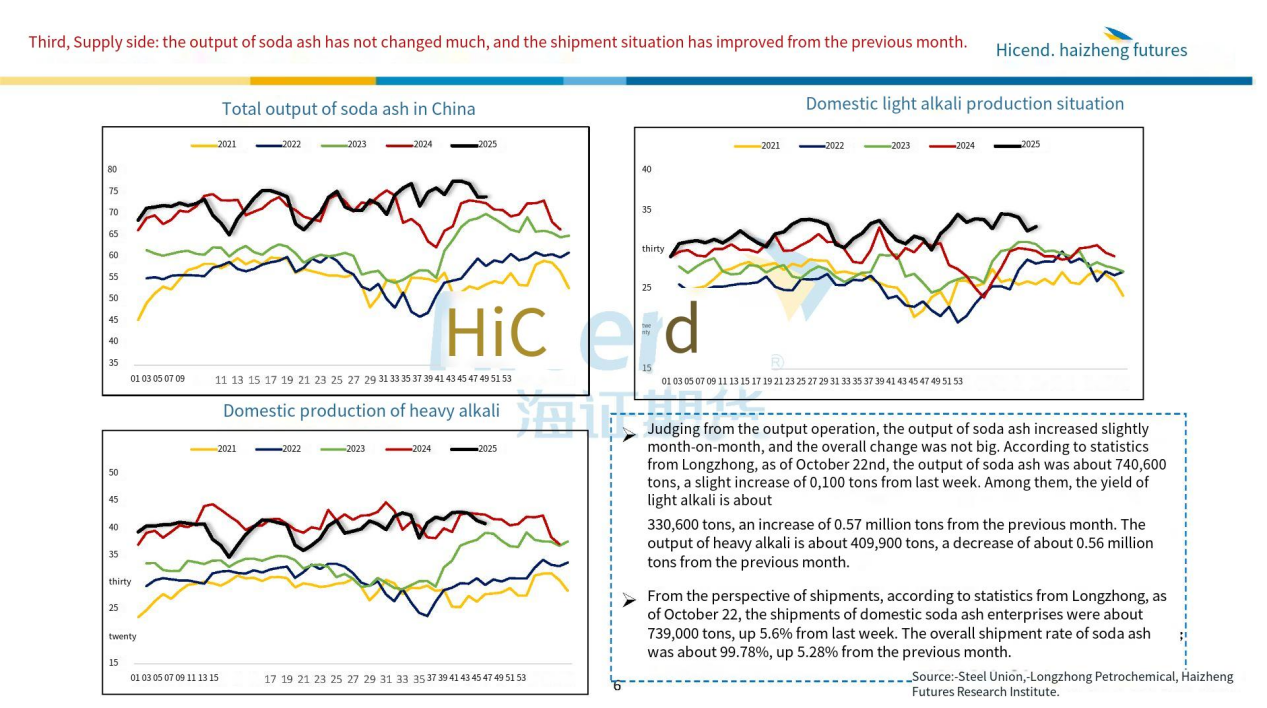

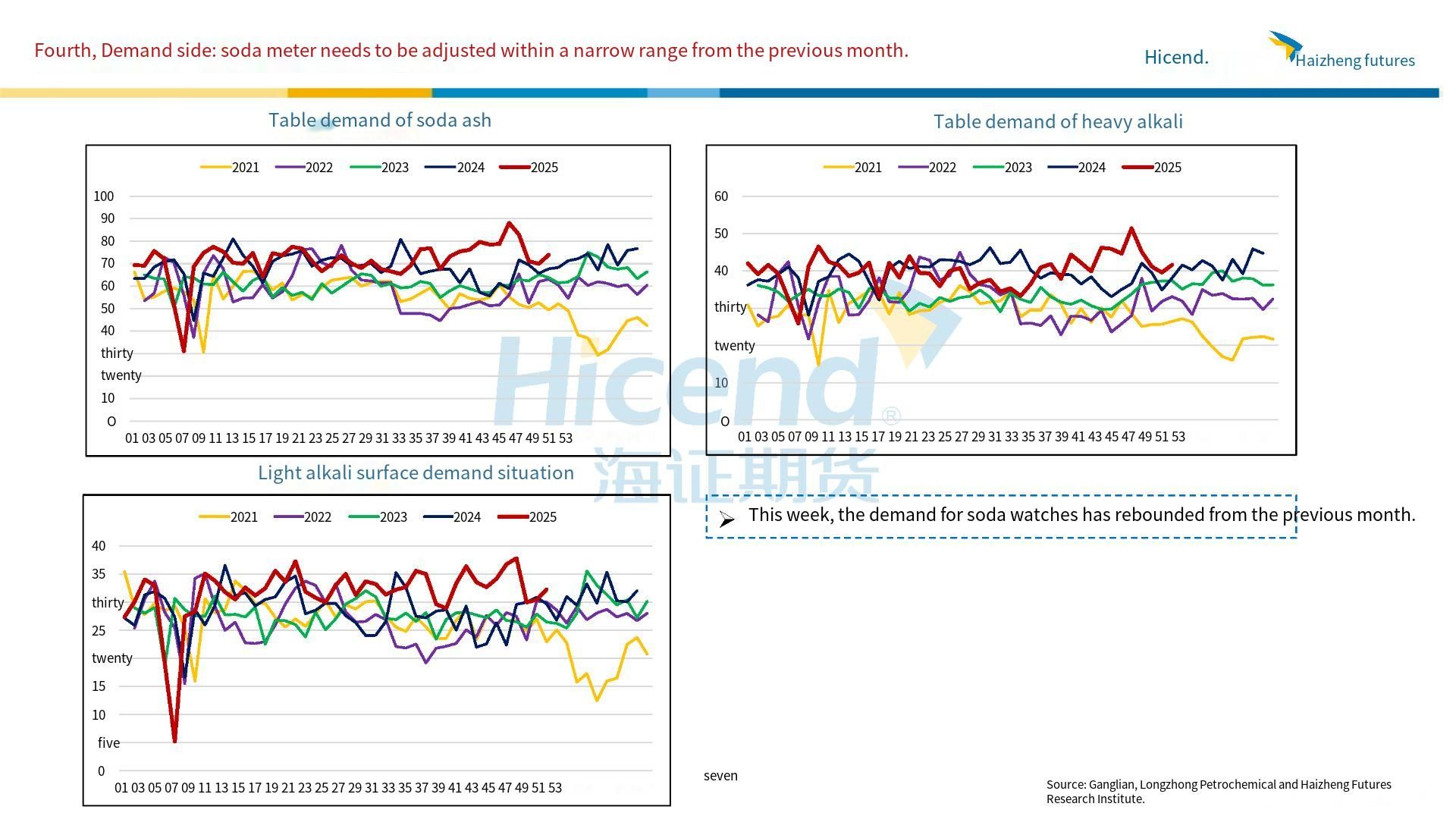

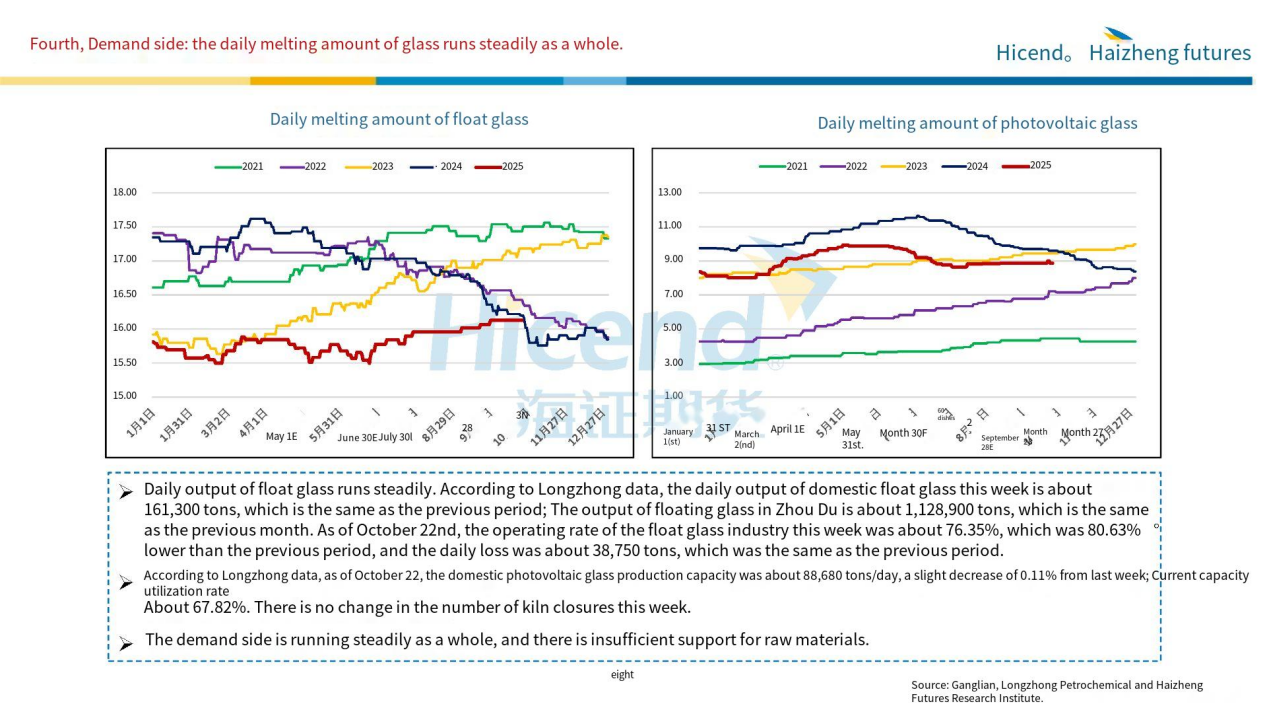

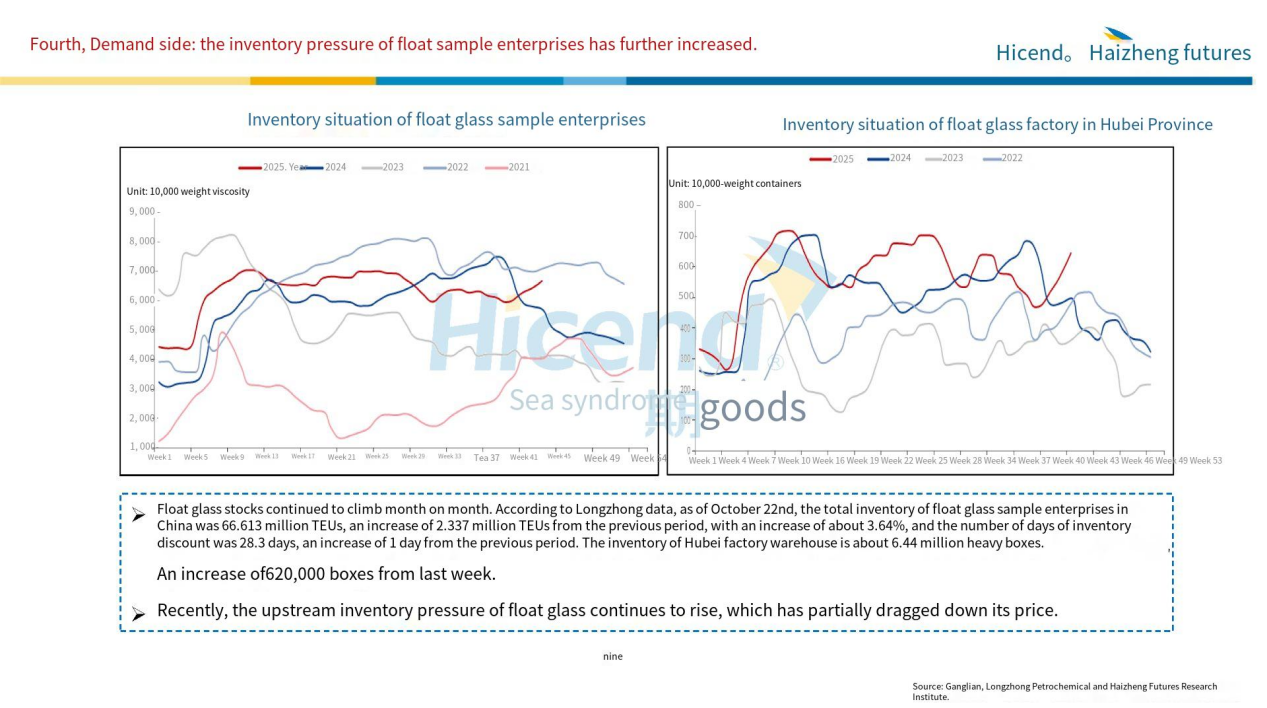

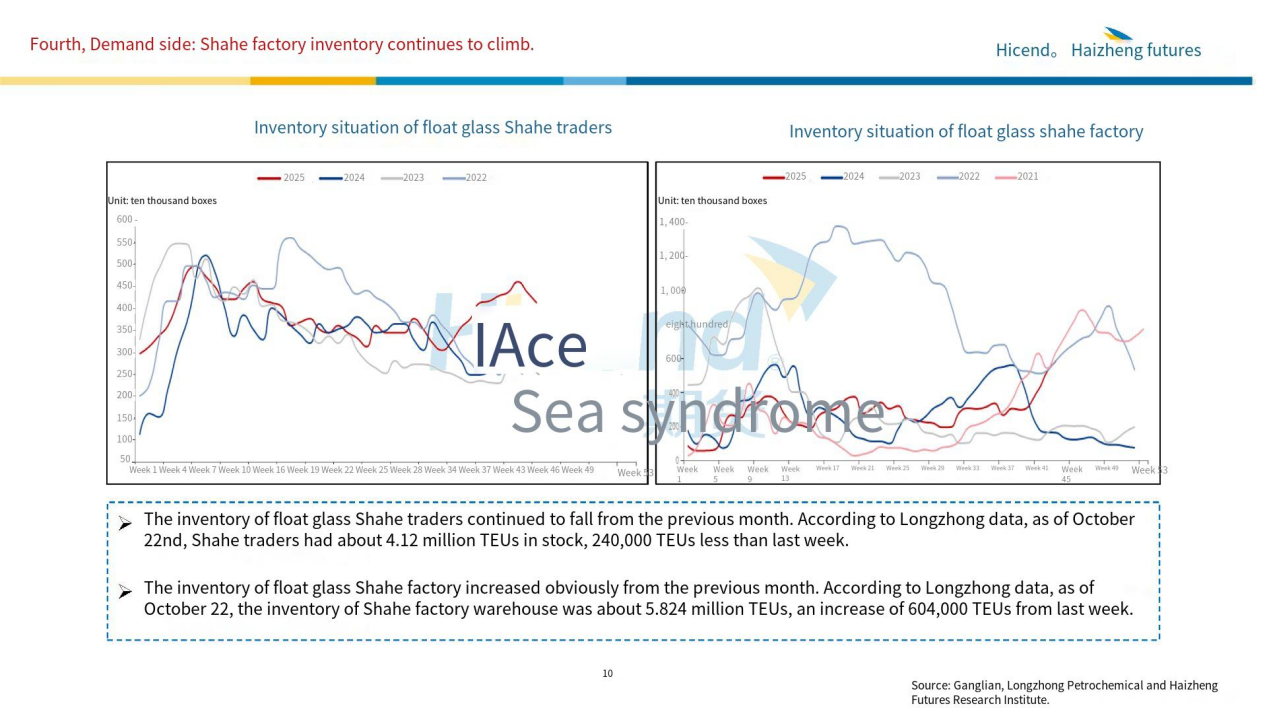

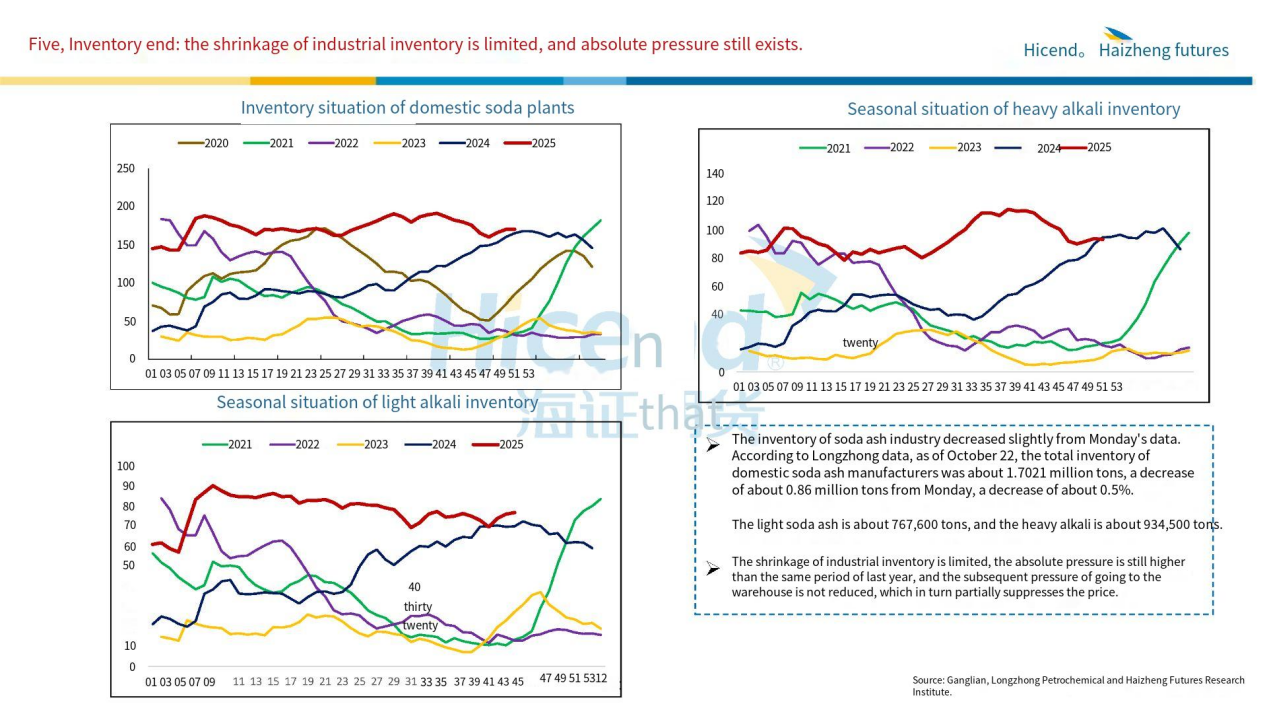

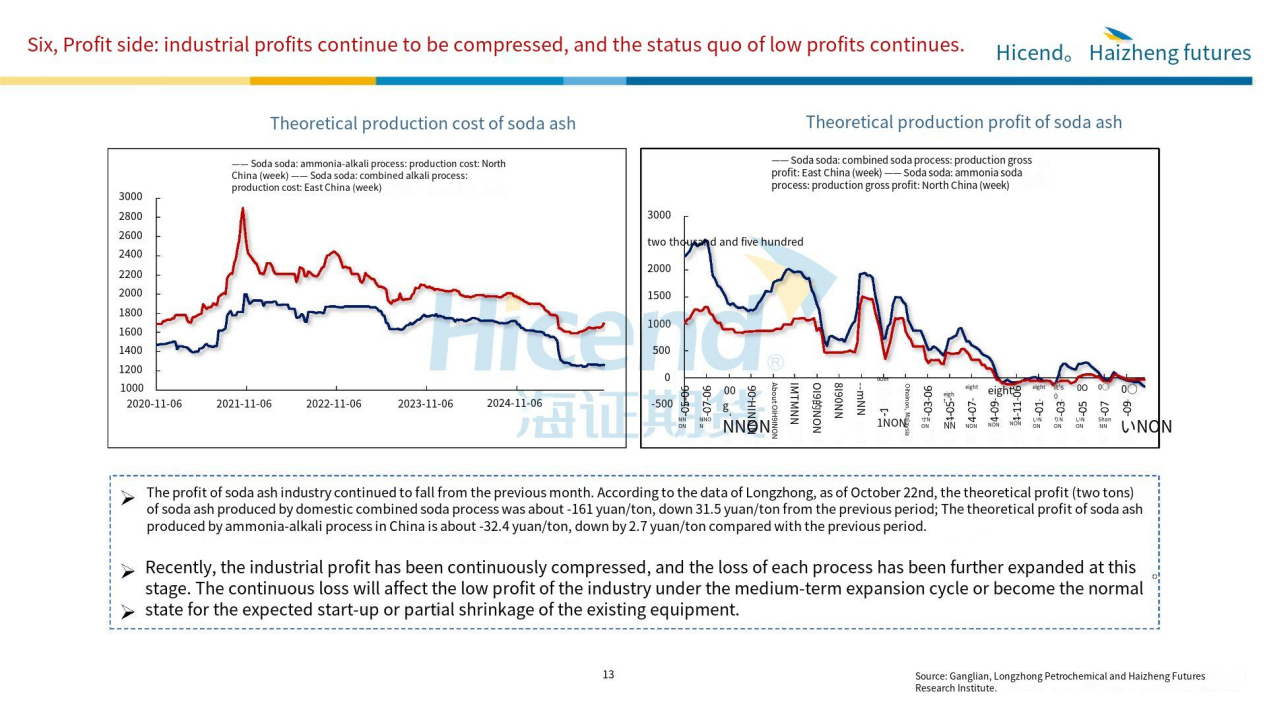

The soda ash market has recently exhibited some resilience against declines, primarily buoyed by macroeconomic expectations rather than significant shifts in its own supply-demand dynamics. Fundamentally, production rates saw a marginal weekly increase. With ongoing plant maintenance and resumption activities, supply is likely to remain elevated in the near term. Downstream demand persists at a weak but stable level, with subdued purchasing sentiment. Short-term destocking may exert some downward pressure on prices. Additionally, recent firm coal prices are gradually providing cost support. Overall, soda ash supply-demand dynamics have not fundamentally improved at present. Futures prices have stabilised under the influence of macro policy expectations. In the short term, prices may undergo oscillatory adjustments, while medium-term prospects remain weak amid expectations of supply-demand looseness.

For arbitrage strategies, maintain a cautious short-term position in the soda ash 01&05 spread. Regarding options, consider moderately reducing positions in previously sold main call options, with strict risk management and stop-loss measures.